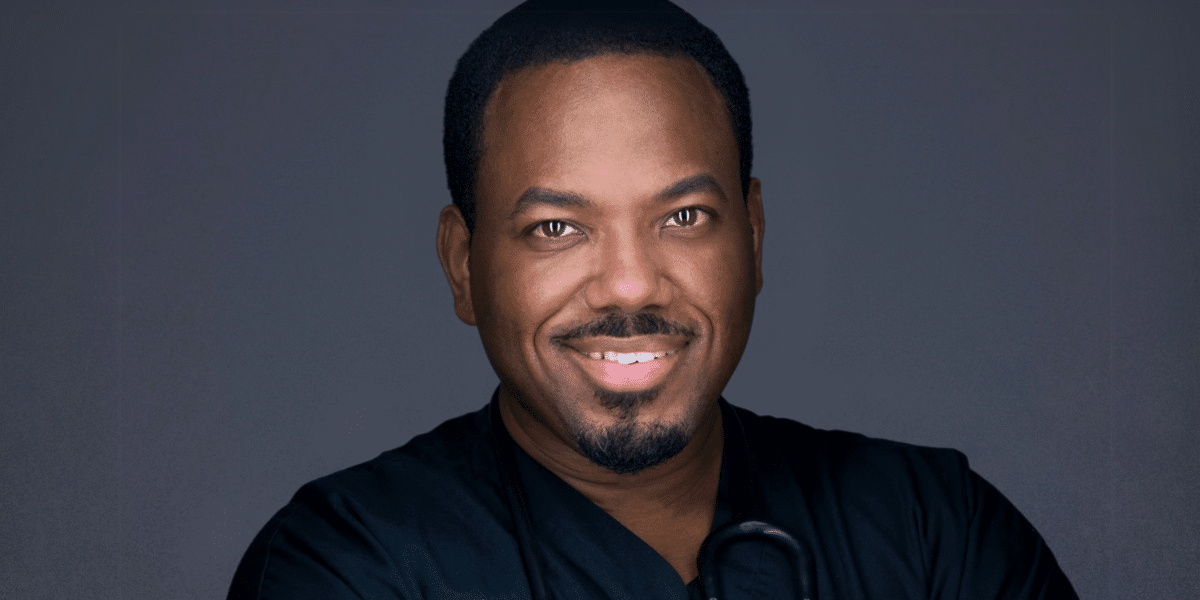

By: James Brown

According to CNBC, 90% of Americans say money affects their stress levels. Despite this, many take a more passive approach to managing their finances.

At all income levels, a passive approach can be extremely detrimental, especially when you are trying to grow and effectively manage your wealth. Even if you have been able to take a more hands-off approach in the past, passivity rarely yields good long-term outcomes.

With this in mind, I recently chatted with Ramsey Brock, president of Brock Asset Management. His insights reveal several key signs that indicate when you should become more proactive with wealth management and seek professional assistance.

1. You Don’t Have Clear Financial Goals

One of the common issues Brock sees in his work is a lack of clear goals. Surveys have found that as many as 64% of Americans aren’t prepared for retirement, with nearly half expecting to have less than $10,000 available when they retire. Escaping this situation becomes extremely difficult without a clear financial goal (and accompanying plan).

“Most people have a vision for what they want their future to look like in retirement, but most of the time, they don’t have a concrete financial plan for how to make this a reality,” he explains. “The better you can clearly define your goals, the easier it becomes to determine the financial thresholds you’ll need to achieve. This allows you to successfully work with a financial advisor to identify the strategies and plan to help you reach these goals.”

2. Your Tax Burden Has Grown

As wealth increases, so does your tax burden. And if your financial growth has occurred in part thanks to investments in the stock market and other assets, your tax situation could become even more complicated.

“Proactive wealth management helps you understand and prepare for the various taxes that could impact your wealth, both now and in the future,” Brock says. “Capital gains, income, and inheritance taxes may all significantly influence how you can use your money — including passing wealth on to your family. Understanding how to position and utilize your assets can significantly reduce your tax burden.”

3. You’re Unsure How Changes Could Affect Your Finances

Even if you have a general wealth management plan, it can take time to understand how life changes or other decisions could affect your overall financial strategy. However, changes such as the birth of children (and major expenses like sending them to college) will affect practically every household at some point.

“Effective wealth management requires you to consider the life decisions and events that will affect your finances,” Brock says. “With a proactive mindset and professional assistance, you have a more informed lens through which to view decisions like whether switching to a different job will keep you in line with your financial goals or how saving for your child’s college tuition will affect your ability to save for retirement.”

4. You’re Uncertain How to Invest Effectively

An estimated 62% of adults in the United States invest in the stock market. And while the stock market as a whole has historically generated annual returns of roughly 10%, this doesn’t mean that every investor is seeing these kinds of outcomes. In fact, research indicates that 70% of DIY investors lose money due to their attempts to time the market, emotional investing and other mistakes.

“Investing is tricky and should always be approached with a long-term mindset,” Brock advises. “Reducing your risk so that your investment strategy helps you achieve your financial goals requires a much more proactive approach. You need to understand the underlying fundamentals of the stocks you invest in, use a stop-loss strategy to minimize losses, avoid emotional decisions, and focus on spending time in the market rather than trying to time the market.”

Professional guidance can help investors develop a portfolio balance that implements these strategies while matching their risk tolerance and growth goals.

5. Your Finances Are Growing Too Complicated for You

As the previously cited points make clear, the need for more proactive wealth management comes down to one overriding factor: a financial situation growing too complicated for you to manage independently. Whether due to a lack of time, knowledge, or clear direction, passively hoping things will turn out okay without a defined strategy can prove disastrous in the long run.

Instead, households can gain a clear understanding of their finances and ensure that all elements of their financial picture align with their goals by proactively seeking professional help and educating themselves on premier practices.

A Proactive Approach Is Ideal

As Brock’s examples illustrate, several scenarios could indicate that you need to become more proactive with your wealth management strategy, including by working with a professional financial advisor. By closely monitoring your financial picture and taking the necessary steps to get on track with your long-term financial goals, you can have greater confidence in managing your finances.

Disclaimer: This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

Published by: Khy Talara